LIGHT ART VR

2022 ReportDear investors,

We are grateful for your support and belief in our company. Our dedication to pushing the boundaries of VR technology content creating would not be possible without your investment. We are proud of the innovative solutions we have developed and confident in their potential to change how we experience media. We are committed to delivering our customers the highest quality content and immersive experiences. Please know that we value your trust and partnership, and we look forward to sharing more exciting developments with you.

We need your help!

I wanted to take a moment to discuss the different ways you can help support Light Art VR. One easy way is introducing us to board members of Islamic schools, mosques, Islamic museums, Hajj travel agents, or mall operators in the Middle East. These organizations can benefit significantly from our immersive VR experiences, and your introduction can open up new opportunities for us to showcase our technology.

Another way to support Light Art VR is by spreading the word about our innovative solutions to your network of contacts about our developing cutting-edge VR content and experiences that engage and inspire audiences.

We also welcome feedback and suggestions from our investors on how we can improve and grow as a company. Your input is valuable to us, and we are committed to listening and incorporating your ideas into our future plans.

Thank you for your ongoing support and partnership with Light Art VR. Together, we can bring the power of VR technology to a broader audience and transform how people experience Islamic culture.

Our Mission

With our royalty model, we stand to benefit from potentially the millions of Islamic locations across the globe that will have access to license our content. These mosques, schools, museums, amusement parks, and entertainment locations will pay licensing fees. As our library of productions continues to grow, we will use our assets to create newer interactive and gaming experiences.

How did we do this year?

Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and the related notes and other financial information included elsewhere in this offering. Some of the information contained in this discussion and analysis, including information regarding the strategy and plans for our business, includes forward-looking statements that involve risks and uncertainties. You should review the “Risk Factors” section for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Overview

Virtual Reality CG content for an untapped market of over 1.8 billion Muslims

As Muslim founders, we strive to fill the void by producing Islamic Entertainment that not only uses cutting-edge technology but also provides the accurate values of Islamic traditions.

At Light Art VR, we are the first movers in creating unmatched magical experiences of Islamic historical events for the 1.8 billion Muslims around the world.

Our team of talented computer-generated artists also creates non-religious custom content for different government agencies.

We design & manufacture our own VR motion chairs adding exclusive special effects & accurate motion controls.

With our royalty model, we stand to benefit from potentially the millions of Islamic locations across the globe that will have access to license our content. These mosques, schools, museums, amusement parks, and entertainment locations will pay licensing fees. As our library of productions continues to grow, we will use our assets to create newer interactive and gaming experiences.

Milestones

Light Art VR Inc was incorporated in the State of Delaware in November 2018.

Since then, we have:

- 💪🏻Closed our first $1.6 Million dollar government contract in the Middle East.

- 💰Valuable portfolio of company-owned Intellectual Property.

- 🎨Hosting some of the best CG artists and animators in the VR Industry.

- Highly profitable potential with our recurring revenue model.

- Up to date implementing the newest technology in motion and game engine.🕹

- Creative advantage due to our award-winning directors. 🎬

- Created proprietary software and playback integration using 8K technology.

Historical Results of Operations

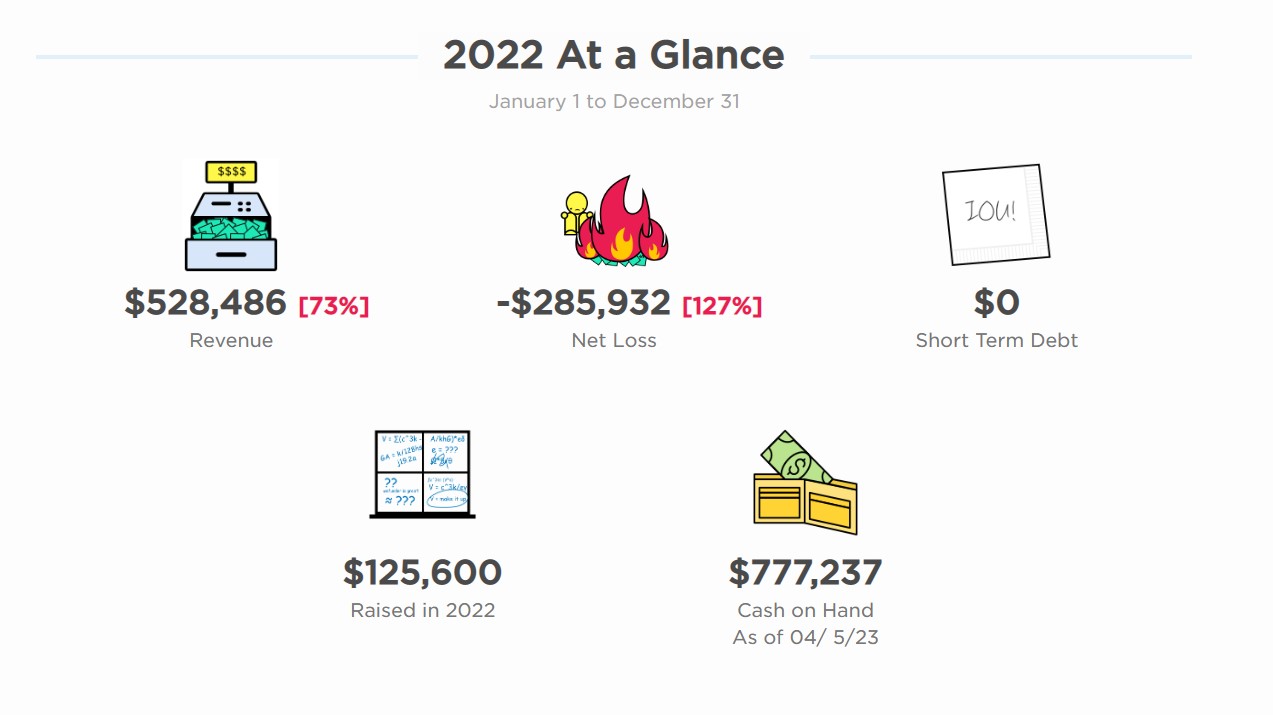

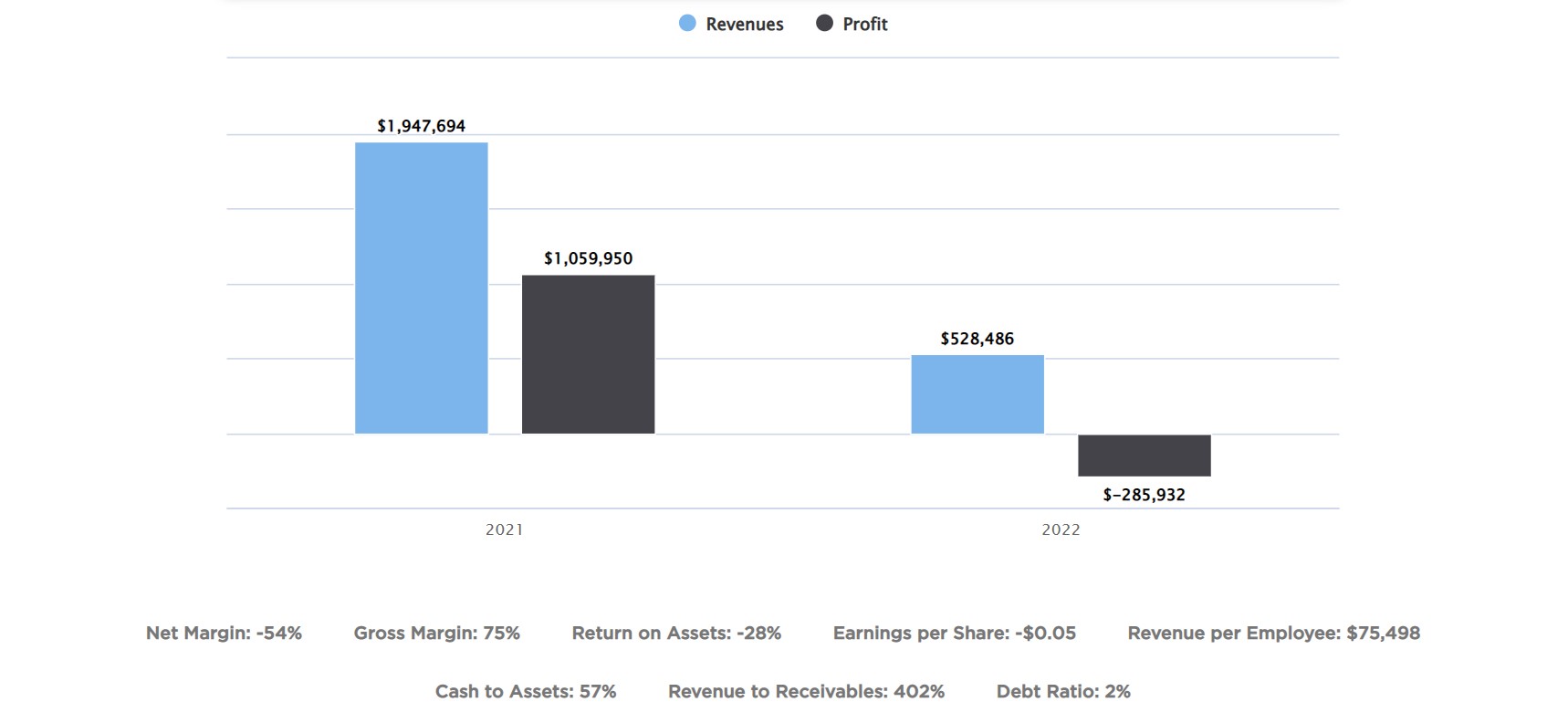

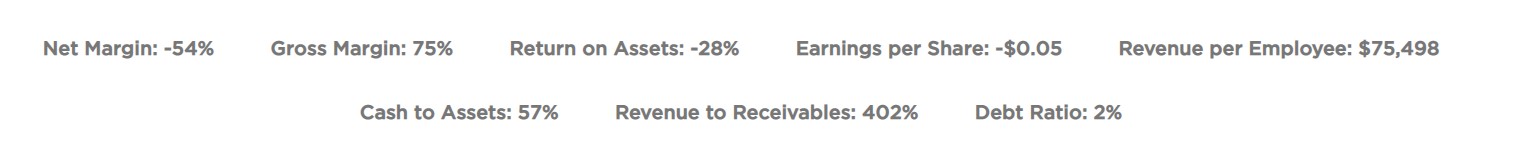

- Revenues & Gross Margin. For the period ended December 31, 2022, the Company had revenues of $528,486 compared to the year ended December 31, 2021, when the Company had revenues of $1,947,694. Our gross margin was 74.86% in fiscal year 2022, compared to 68.74% in 2021.

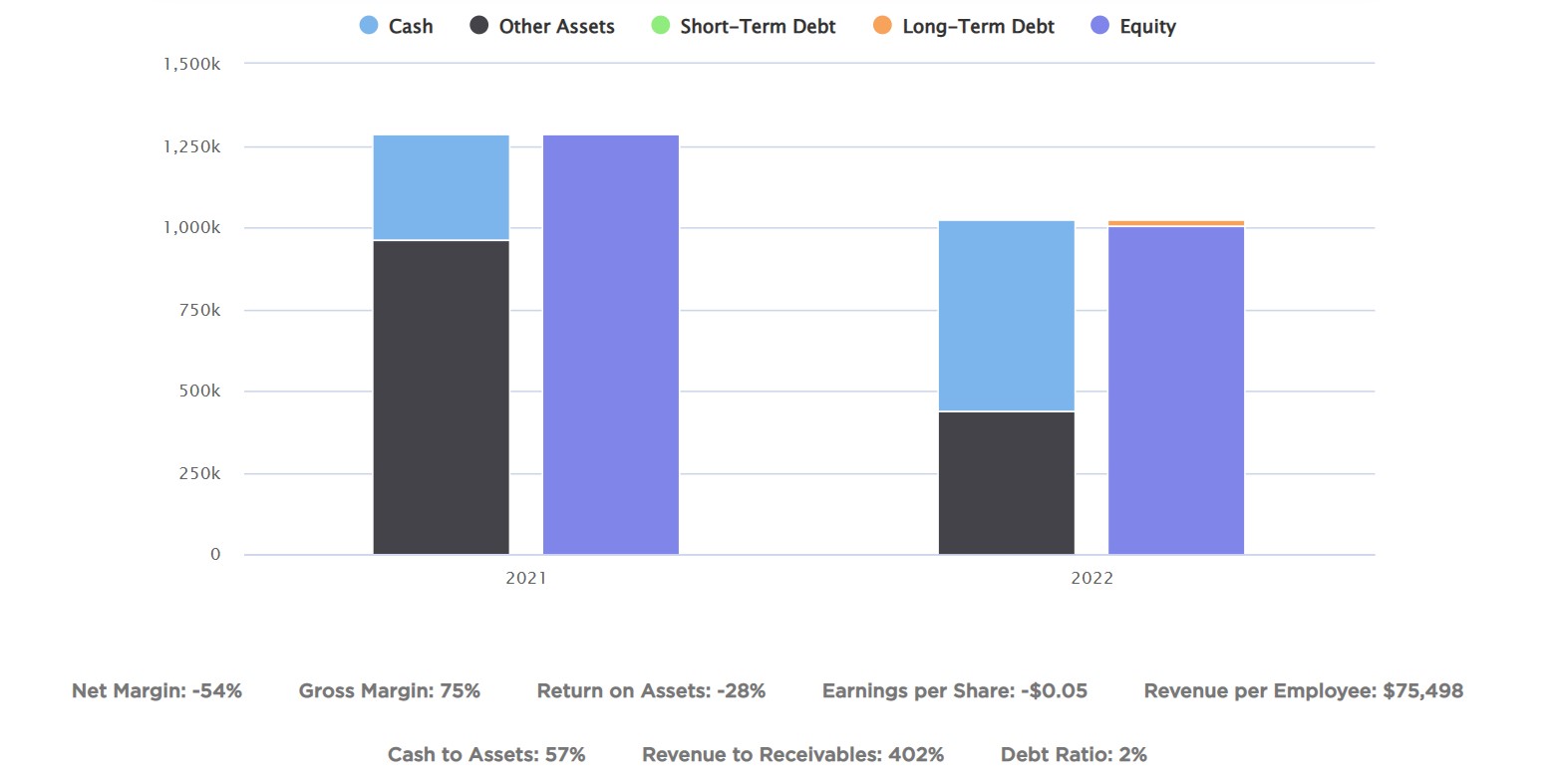

- Assets. As of December 31, 2022, the Company had total assets of $1,022,113, including $584,759 in cash. As of December 31, 2021, the Company had $1,284,792 in total assets, including $325,095 in cash.

- Net Loss. The Company has had net losses of $285,932 and net income of $1,059,950 for the fiscal years ended December 31, 2022 and December 31, 2021, respectively.

- Liabilities. The Company’s liabilities totaled $17,510 for the fiscal year ended December 31, 2022 and $0 for the fiscal year ended December 31, 2021.

Related Party Transaction

Refer to Question 26 of this Form C for disclosure of all related party transactions.

Liquidity & Capital Resources

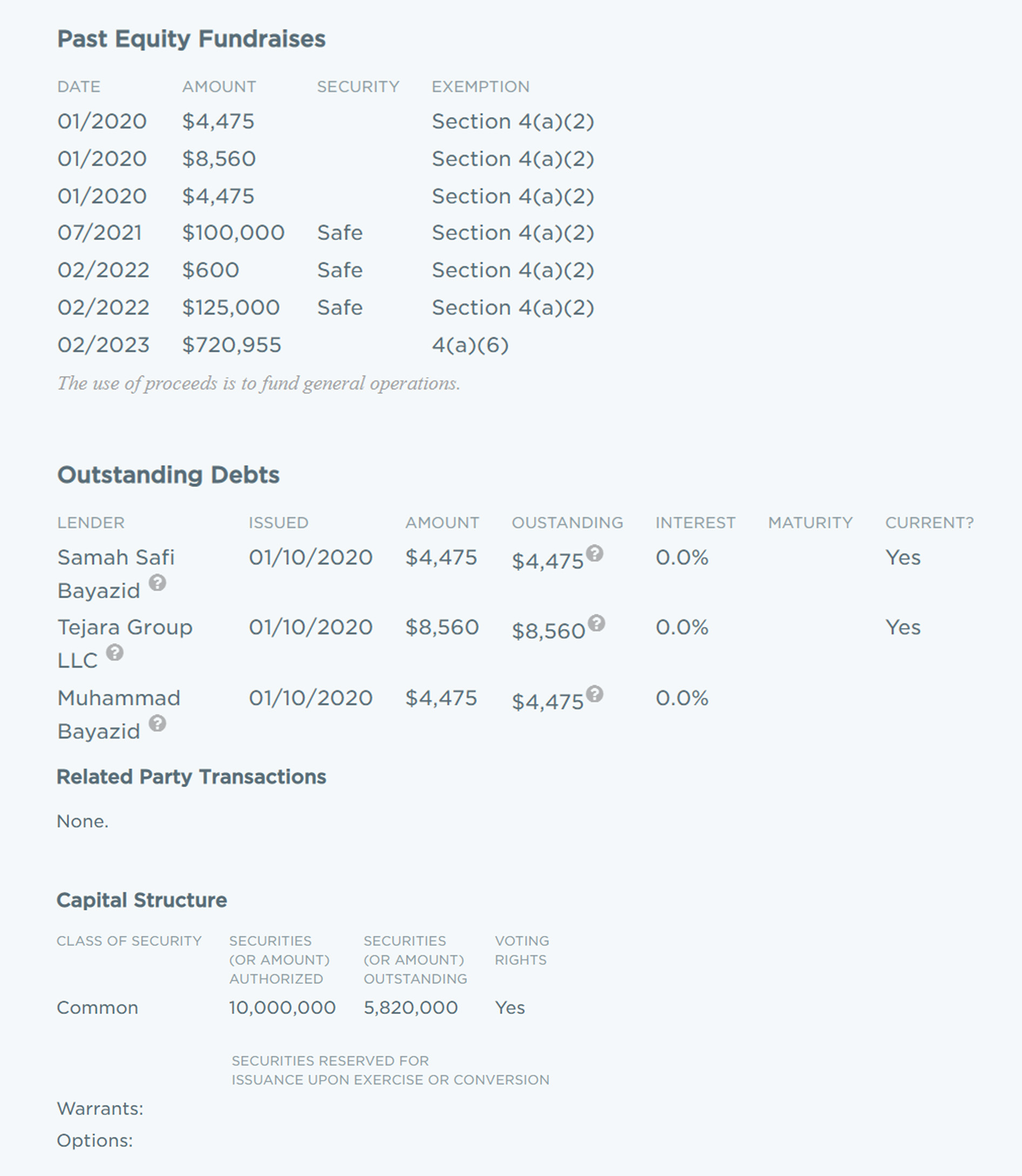

To-date, the company has been financed with $17,510 in debt and $225,600 in SAFEs.

After the conclusion of this Offering, should we hit our minimum funding target, our projected runway is 12 months before we need to raise further capital.

We plan to use the proceeds as set forth in this Form C under “Use of Funds”. We don’t have any other sources of capital in the immediate future.

We will likely require additional financing in excess of the proceeds from the Offering in order to perform operations over the lifetime of the Company. We plan to raise capital in 12 months. Except as otherwise described in this Form C, we do not have additional sources of capital other than the proceeds from the offering. Because of the complexities and uncertainties in establishing a new business strategy, it is not possible to adequately project whether the proceeds of this offering will be sufficient to enable us to implement our strategy. This complexity and uncertainty will be increased if less than the maximum amount of securities offered in this offering is sold. The Company intends to raise additional capital in the future from investors. Although capital may be available for early-stage companies, there is no guarantee that the Company will receive any investments from investors.

Runway & Short/Mid Term Expenses

Light Art VR Inc cash in hand is $777,237, as of April 2023. Over the last three months, revenues have averaged $35,000/month, cost of goods sold has averaged $15,000/month, and operational expenses have averaged $88,000/month, for an average burn rate of $68,000 per month. We intend to be profitable in 12-24 months.

We repaid all outstanding Debt and side loans of over $552,000. The company is virtually debt-free and has a large library of Intellectual Property. We are somewhat profitable. However, we are reinvesting in our intellectual property to build our library of licensed productions to generate a better royalty in the future. We also plan to install our major attraction at one of Indonesia’s largest parks. We will need to raise $1 Million for the buildout, but our royalty should be around $1 Million in revenue per year from this single location. This location will be a marketing site to entice future property partners to install our setup on a revenue-sharing model. All projections in the above narrative are forward-looking and not guaranteed.

Thank You!

From the Light Art VR Team

Fahim Aref

Chief Financial Officer

Samah Safi Bayazid

Producer/Writer

Muhammad Bayazid

CEO

READ MORE

Risks

Since we are in the early stages of our company if any of the founders get ill or an unforeseen circumstance arises where they are not able to work, it will jeopardize our quality and workflow.

We have a first movers advantage for Islamic content creation and motion platforms, however, if other competitors enter the Islamic content space that are better funded than us, and can afford larger CG teams, it will make it more difficult.

As the Metaverse fully develops, it will make it more difficult to retain top CG artists in the world, this will increase costs of developing further intellectual property.

Covid or any other pandemics will hurt our business since we are an onsite reseller and our products are shared between users.

We are still in the early development of VR Technology. Later studies may show the adverse risks associated with using VR technology.

Even though an encrypted system is being used and developed in-house, our VR Intellectual Property can be hacked or stolen, or leaked to the public. This may affect retention with clients.

The Company may never receive a future equity financing or elect to convert the Securities upon such future financing. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an IPO. If neither the conversion of the Securities nor a liquidity event occurs, the Purchasers could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

Rami Afaneh is a part-time officer. As such, it is likely that the company will not make the same progress as it would if that were not the case.

Our future success depends on the efforts of a small management team. The loss of services of the members of the management team may have an adverse effect on the company. There can be no assurance that we will be successful in attracting and retaining other personnel we require to successfully grow our business.

Description of Securities for Prior Reg CF Raise

Additional issuances of securities. Following the Investor’s investment in the Company, the Company may sell interests to additional investors, which will dilute the percentage interest of the Investor in the Company. The Investor may have the opportunity to increase its investment in the Company in such a transaction, but such opportunity cannot be assured. The amount of additional financing needed by the Company, if any, will depend upon the maturity and objectives of the Company. The declining of an opportunity or the inability of the Investor to make a follow-on investment, or the lack of an opportunity to make such a follow-on investment, may result in substantial dilution of the Investor’s interest in the Company.

Issuer repurchases of securities. The Company may have authority to repurchase its securities from shareholders, which may serve to decrease any liquidity in the market for such securities, decrease the percentage interests held by other similarly situated investors to the Investor, and create pressure on the Investor to sell its securities to the Company concurrently.

A sale of the issuer or of assets of the issuer. As a minority owner of the Company, the Investor will have limited or no ability to influence a potential sale of the Company or a substantial portion of its assets. Thus, the Investor will rely upon the executive management of the Company and the Board of Directors of the Company to manage the Company so as to maximize value for shareholders. Accordingly, the success of the Investor’s investment in the Company will depend in large part upon the skill and expertise of the executive management of the Company and the Board of Directors of the Company. If the Board Of Directors of the Company authorizes a sale of all or a part of the Company, or a disposition of a substantial portion of the Company’s assets, there can be no guarantee that the value received by the Investor, together with the fair market estimate of the value remaining in the Company, will be equal to or exceed the value of the Investor’s initial investment in the Company.

Transactions with related parties. The Investor should be aware that there will be occasions when the Company may encounter potential conflicts of interest in its operations. On any issue involving conflicts of interest, the executive management and Board of Directors of the Company will be guided by their good faith judgement as to the Company’s best interests. The Company may engage in transactions with affiliates, subsidiaries or other related parties, which may be on terms which are not arm’s-length, but will be in all cases consistent with the duties of the management of the Company to its shareholders. By acquiring an interest in the Company, the Investor will be deemed to have acknowledged the existence of any such actual or potential conflicts of interest and to have waived any claim with respect to any liability arising from the existence of any such conflict of interest.

Minority Ownership

An Investor in the Company will likely hold a minority position in the Company, and thus be limited as to its ability to control or influence the governance and operations of the Company.

The marketability and value of the Investor’s interest in the Company will depend upon many factors outside the control of the Investor. The Company will be managed by its officers and be governed in accordance with the strategic direction and decision-making of its Board Of Directors, and the Investor will have no independent right to name or remove an officer or member of the Board Of Directors of the Company.

Following the Investor’s investment in the Company, the Company may sell interests to additional investors, which will dilute the percentage interest of the Investor in the Company. The Investor may have the opportunity to increase its investment in the Company in such a transaction, but such opportunity cannot be assured.

The amount of additional financing needed by the Company, if any, will depend upon the maturity and objectives of the Company. The declining of an opportunity or the inability of the Investor to make a follow-on investment, or the lack of an opportunity to make such a follow-on investment, may result in substantial dilution of the Investor’s interest in the Company.

Exercise of Rights Held by Principal Shareholders

As holders of a majority-in-interest of voting rights in the Company, the shareholders may make decisions with which the Investor disagrees, or that negatively affect the value of the Investor’s securities in the Company, and the Investor will have no recourse to change these decisions. The Investor’s interests may conflict with those of other investors, and there is no guarantee that the Company will develop in a way that is optimal for or advantageous to the Investor. For example, the shareholders may change the terms of the articles of incorporation for the company, change the terms of securities issued by the Company, change the management of the Company, and even force out minority holders of securities. The shareholders may make changes that affect the tax treatment of the Company in ways that are unfavorable to you but favorable to them. They may also vote to engage in new offerings and/or to register certain of the Company’s securities in a way that negatively affects the value of the securities the Investor owns. Other holders of securities of the Company may also have access to more information than the Investor, leaving the Investor at a disadvantage with respect to any decisions regarding the securities he or she owns. The shareholders have the right to redeem their securities at any time. Shareholders could decide to force the Company to redeem their securities at a time that is not favorable to the Investor and is damaging to the Company. Investors’ exit may affect the value of the Company and/or its viability. In cases where the rights of holders of convertible debt, SAFES, or other outstanding options or warrants are exercised, or if new awards are granted under our equity compensation plans, an Investor’s interests in the Company may be diluted. This means that the pro-rata portion of the Company represented by the Investor’s securities will decrease, which could also diminish the Investor’s voting and/or economic rights. In addition, as discussed above, if a majority-in-interest of holders of securities with voting rights cause the Company to issue additional stock, an Investor’s interest will typically also be diluted.

Restrictions on Transfer

The securities offered via Regulation Crowdfunding may not be transferred by any purchaser of such securities during the one year period beginning when the securities were issued, unless such securities are transferred:

- to the issuer;

- to an accredited investor ;

- as part of an offering registered with the U.S. Securities and Exchange Commission; or

- to a member of the family of the purchaser or the equivalent, to a trust controlled by the purchaser, to a trust created for the benefit of a member of the family of the purchaser or the equivalent, or in connection with the death or divorce of the purchaser or other similar circumstance.

Valuation Methodology for Prior Reg CF Raise

The offering price for the securities offered pursuant to this Form C has been determined arbitrarily by the Company, and does not necessarily bear any relationship to the Company’s book value, assets, earnings or other generally accepted valuation criteria. In determining the offering price, the Company did not employ investment banking firms or other outside organizations to make an independent appraisal or evaluation. Accordingly, the offering price should not be considered to be indicative of the actual value of the securities offered hereby.

The initial amount invested in a SAFE is determined by the investor, and we do not guarantee that the SAFE will be converted into any particular number of shares of Preferred Stock . As discussed in Question 13, when we engage in an offering of equity interests involving Preferred Stock , Investors may receive a number of shares of Preferred Stock calculated as either (i) the total value of the Investor’s investment, divided by the price of the Preferred Stock being issued to new Investors, or (ii) if the valuation for the company is more than the Valuation Cap, the amount invested divided by the quotient of (a) the Valuation Cap divided by (b) the total amount of the Company’s capitalization at that time. Because there will likely be no public market for our securities prior to an initial public offering or similar liquidity event, the price of the Preferred Stock that Investors will receive, and/or the total value of the Company’s capitalization, will be determined by our board of directors . Among the factors we may consider in determining the price of Preferred Stock are prevailing market conditions, our financial information, market valuations of other companies that we believe to be comparable to us, estimates of our business potential, the present state of our development and other factors deemed relevant. In the future, we will perform valuations of our stock (including both common stock and Preferred Stock) that take into account, as applicable, factors such as the following:

- unrelated third party valuations;

- the price at which we sell other securities in light of the relative rights, preferences and privileges of those securities;

- our results of operations, financial position and capital resources;

- current business conditions and projections;

- the marketability or lack thereof of the securities;

- the hiring of key personnel and the experience of our management;

- the introduction of new products;

- the risk inherent in the development and expansion of our products;

- our stage of development and material risks related to our business;

- the likelihood of achieving a liquidity event, such as an initial public offering or a sale of our company given the prevailing market conditions and the nature and history of our business;

- industry trends and competitive environment;

- trends in consumer spending, including consumer confidence;

- overall economic indicators, including gross domestic product, employment, inflation and interest rates; and

- the general economic outlook.

We will analyze factors such as those described above using a combination of financial and market-based methodologies to determine our business enterprise value. For example, we may use methodologies that assume that businesses operating in the same industry will share similar characteristics and that the Company’s value will correlate to those characteristics, and/or methodologies that compare transactions in similar securities issued by us that were conducted in the market.

Company

Light Art VR Inc

- Delaware Corporation

- Organized November 2018

- 7 employees

7541 W 99th PL

Bridgeview IL 60455

Business Description

Refer to the Light Art VR profile.

EDGAR Filing

The Securities and Exchange Commission hosts the official version of this annual report on their EDGAR web site. It looks like it was built in 1989.

Compliance with Prior Annual Reports

Light Art VR is current with all reporting requirements under Rule 202 of Regulation Crowdfunding.

All prior investor updates

You can refer to the company’s updates page to view all updates to date. Updates are for investors only and will require you to log in to the Wefunder account used to make the investment.